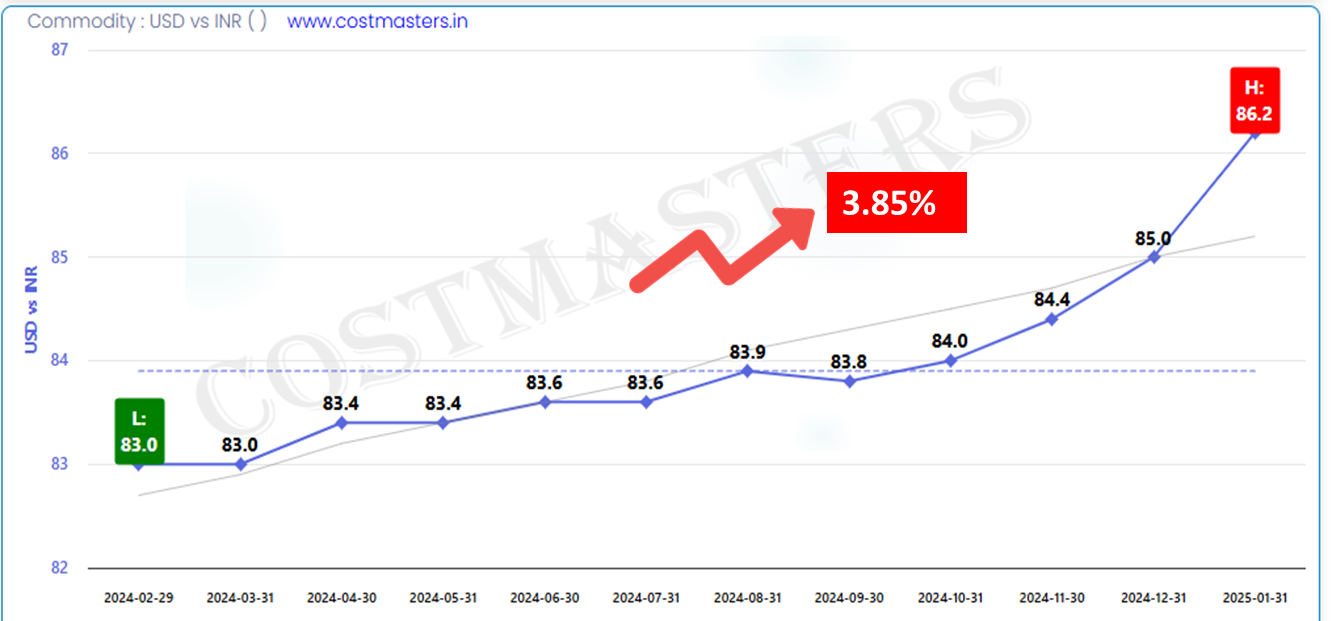

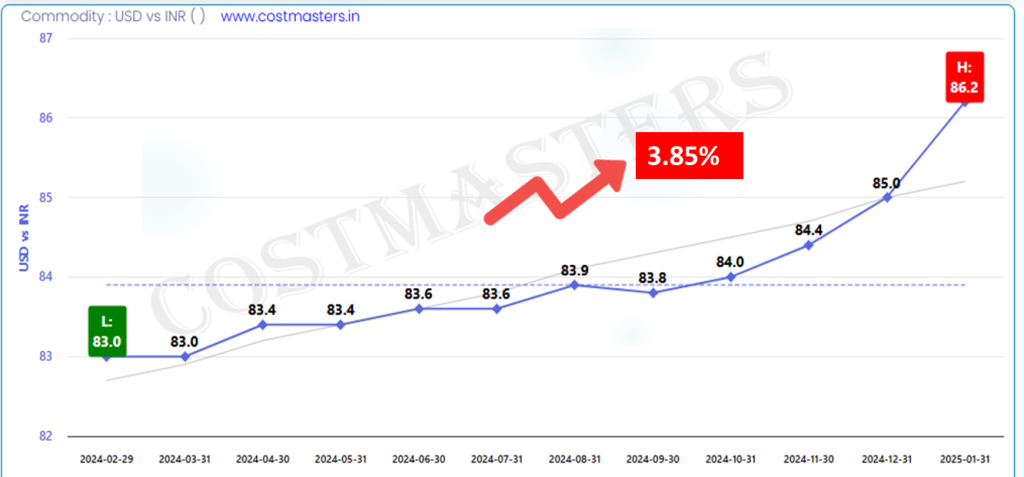

Why Indian Rupees decreasing?

Strong US Dollar

The dollar index is rising due to robust US job growth and good economic data. Increased dollar is widening India’s trade deficit, pressuring the rupee. India imports 85% crude oil needs

Foreign Fund Outflows

FIIs are selling in Indian markets, due to higher US bond returns, market uncertainty & slower than expected GDP growth.

Global Trade War Concerns

US tariffs on major economies are fueling trade war fears, affecting the rupee.

| Pros | Cons |

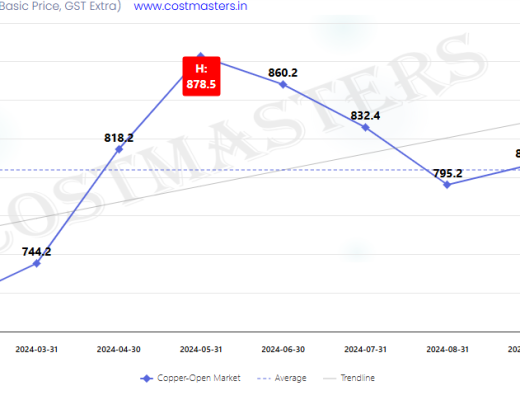

| Export Boost | Increased Import Costs |

| Increased tourism | Risk of Capital Outflows |

| Increased competitiveness | Imported Inflation |

RBI’s action

Currency Intervention

Since October, the RBI has used $50 billion to stabilize the Indian Rupee, leading to an 8-month low in FX reserves.

Repo Rate Cut

The Reserve Bank of India (RBI) have cut the repo rate to inject liquidity into the banking system, making borrowing cheaper and supporting economic growth

Future outlook

•Economists forecast the rupee to be between 86.25 and 88.00 against the dollar by the end of March 2025.

•Long-term trends remain uncertain due to global trade war fears.