Overview

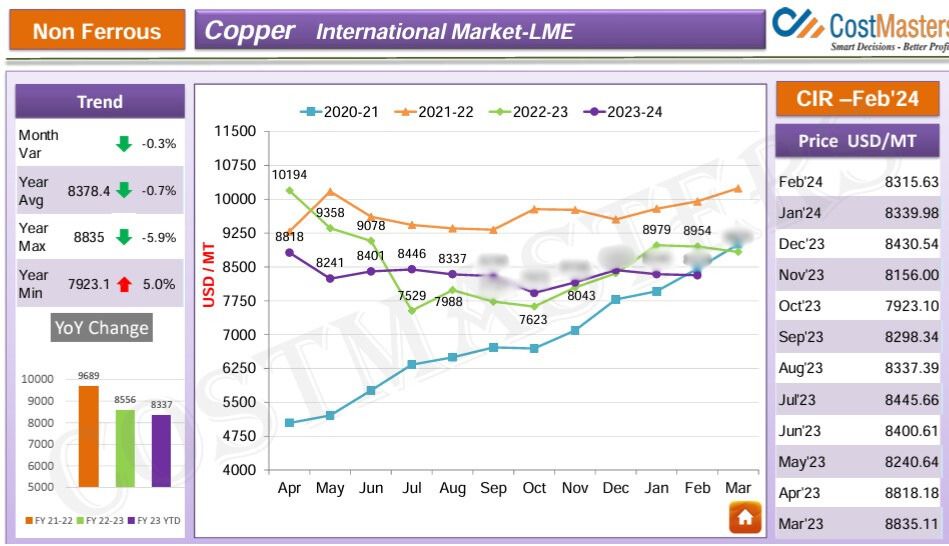

A vital industrial metal, copper has applications in numerous sectors like electronics, transportation, and construction. A complex connection between demand, availability, and geopolitical things affects its price. Knowing these issues will be essential for businesses, investors, and politicians as we move to 2025.

Essential Components Affecting Copper Prices

A number of variables will impact copper’s probable price pattern in 2025:

1. Growth of the Global Economy: A strong world economy can raise interest in copper and drive up prices, particularly in developing countries. The recession or downturns in the economy, however, might decrease demand and push down prices.

2. Supply-Demand Dynamics: Future copper prices will be strongly impacted by the balance between demand and supply. Availability will be affected by variables like the rate of recycling, interruptions in production, and new mining developments. Demand will be shaped on the side of demand by elements including the growth of renewable energy sources, the rise of the auto sector, and the development of infrastructure.

3. Geopolitical Factors: Distribution networks, the cost of energy, and the overall state of economy can all be impacted by international conflicts, trade wars, and policy changes, which in turn can affect copper future prices.

4. Energy Costs: The price of energy, especially power, is a major factor in the production of copper. Changes in energy costs may impact the cost for manufacturing and, in turn, the price of copper.

5. Technological Developments: Demand as well as supply dynamics may be affected by developments in the techniques used in the manufacturing and recycling of copper.

2025 Copper Price Forecast

Although it can be hard to forecast precise pricing, a number of factors point to a possible increase trend in copper future prices in 2025:

• High Demand from Emerging Markets: As a result to their fast industrialisation, developing economies—especially those from Asia—are driving up the need for copper.

• Electrification and Renewable Energy: Since copper is an essential component of solar panels, batteries, and wind turbines, a greater emphasis on electric cars and sources of clean energy will increase demand for copper.

• Limited Supply expansion: The time and money required to establish fresh mines may restrict the growth of the supply.

However, it’s crucial to take into account any adverse risks like supply chain interruptions, international conflicts, and economic slowdowns.

Conclusion

Future copper prices are affected by world politics, advances in technology, and global economic trends. Even though 2025 is expected to be an excellent year, it’s important to keep up with economic developments as well as potential hazards. Businesses and investors may navigate the constantly shifting economic environment and make informed choices by knowing the main factors driving copper pricing.