Introduction

The price fluctuations of different plastic grades can have a significant impact on industries ranging from packaging to the automotive sector. This article explores the main factors influencing plastic prices in India, current trends, and 2024 predictions. Plastic is a versatile material with countless applications that has become an integral part of our daily lives.

Track Plastic Price Per KG

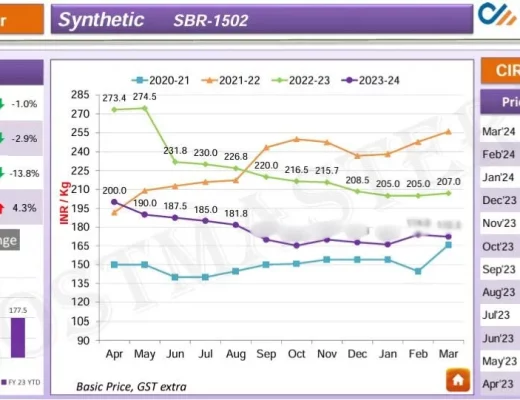

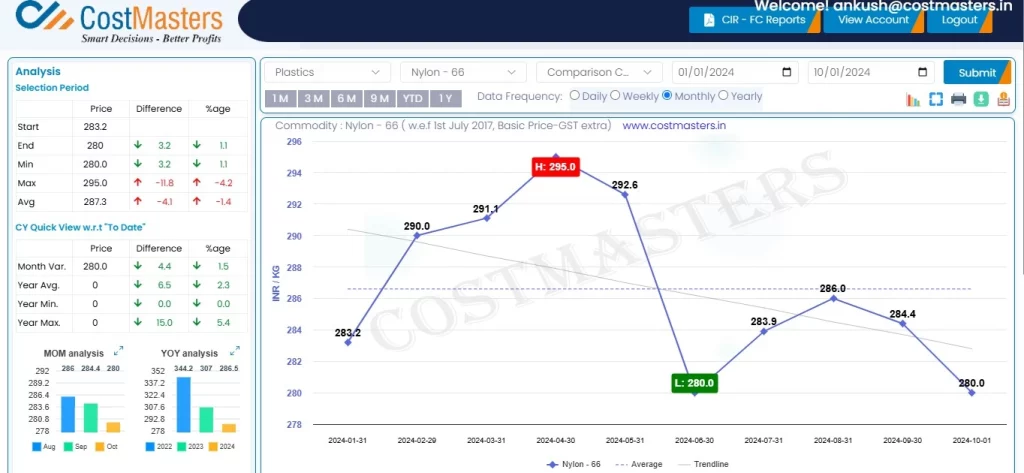

Founded in 2013, CostMasters is committed to provide the plastics sector accurate and up-to-date pricing information. Since the beginning, we have made it our goal to provide consumers with easy access to real-time market data by publishing daily plastic prices on our internet platform. Users can monitor the most recent plastic price per kg with a few clicks, keeping them updated on any changes and patterns that might affect their choices to buy or sell. We provide a free trial so you can see the full potential of our platform. During this time, our team walks you through the live monitoring tools and shows you how to keep an eye on the most recent plastic price per kg in real time. See how simple it is to keep informed by looking at a sample of our data below,

Why are Plastics Price Increasing?

- Increasing Raw Material Cost Main Raw Material – Crude Oil Any movement in Crude prices directly impacts Plastic Prices. The crude oil price has increased by 8.6%.

- Increasing Plastics Exports In February 2024, India exported plastics worth $997 million, an of 14.3% from $872 million in February 2023. The cumulative value of plastics exports during April 2023 – February 2024 was $10,433 million, as against $10,911 million during the same period last year , resulting in better cost realization in exports and hence less supply for Indian market.

- High demand in Indian Market Industries that use a lot of plastic, like Packaging, Automotive, and Construction, are growing in India. This creates even more demand for plastic, driving prices up.

Future Price trends

The future prices of plastics will be influenced by factors such as supply chain disruptions, raw material costs, and growth in key sectors. In the short term, prices may continue to rise, but they might stabilize in the long term.

Plastic Price related News 2024

- India’s plastic exports rose by 12.7% in December-23 and 5% in January-24 Year-On-Year

India’s plastic exports grew by 12.7% in December 2023 and 5.0% in January 2024, with key gains in consumer products, plastic films, and raw materials. Despite challenges in sectors like cordage and writing instruments, Plexconcil aims for USD 25 billion in exports by 2027, focusing on markets in Latin America, CIS, and Africa, and recently exploring opportunities in Russia’s USD 14 billion plastics market.

Source: Economic Times

- India’s plastic exports rise over 14% on-year to $997 million in February

In February 2024, India exported plastics worth $997 million, an increase of 14.3% from $872 million in February 2023. The cumulative value of plastics exports during April 2023 – February 2024 was $10,433 million, as against $10,911 million during the same period last year, registering a decline of 4.4%.

Source: Economic Times

- India recycles only 8 percent of its plastic waste, reveals study

A study reveals India recycles just 8% of its plastic waste, with a slight increase to 11% by 2035 as plastic use rises from 24.1 to 70.5 million tones. Informal sector practices and low policy compliance hinder waste management. The report calls for a circular economy to reduce virgin plastic use and improve recycling, emphasizing better policies, implementation, and household behavior changes.

Source: The Week

- Plastic prices hit record high to stoke inflation concerns

Raw materials like copper, steel, lumber, and plastics are hitting record highs. Supply shortages from last year’s hurricanes and a Texas freeze are disrupting industries. Honda and Toyota are cutting vehicle production due to petrochemical shortages. Rising prices are fueling inflation concerns as demand surges with the economy reopening. The Federal Reserve sees these hikes as temporary, but industries are strained. Long-term, petrochemicals will drive significant oil demand growth.

Source: Economic Times