Recent Rubber Price Trends

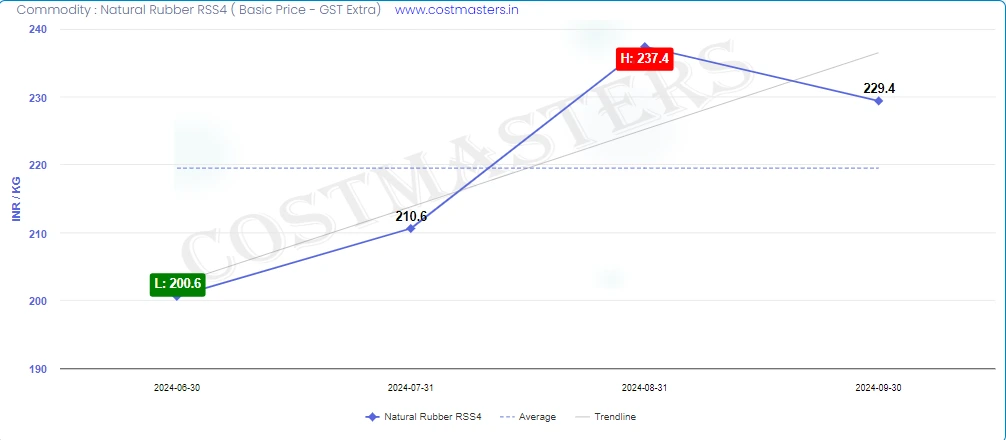

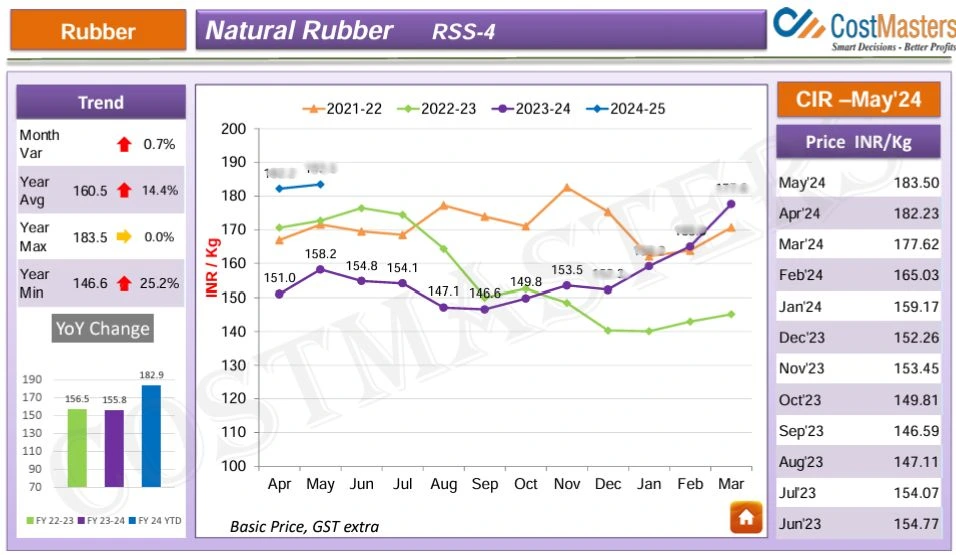

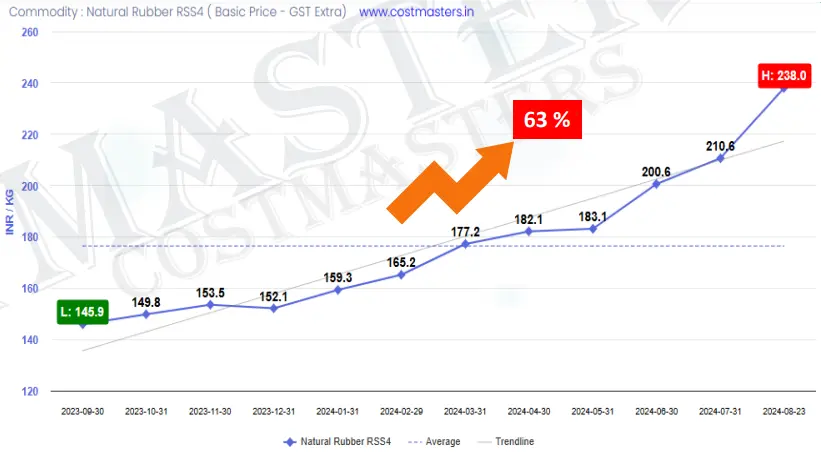

RSS4 rubber price had touched its peak price this year but now coming back to normal. Now you can track the real-time natural rubber prices with few clicks. Book free demo for full demonstration of our comprehensive raw material price tracking services. The dashboard of CostMasters is easy to navigate through. Whether you are living in Kottayam or Assam, you will get accurate RSS4 rubber price per kg in India. Kottayam is the Rubber capital of India because it is the largest producer of rubber in India.

Keep yourself informed about the most recent rubber rates in India. Obtain up-to-the-minute updates on the current price of natural rubber in major markets such as Kottayam. Explore the prevailing price of rubber per kg in Assam along with the overall trends across the country. If you are a farmer, trader, or manufacturer, our platform offers precise and up-to-date information on today’s rubber price. Use our dependable price analysis tools to make well-informed decisions.

CostMasters is trusted brand in India to track the rss4 natural rubber prices at affordable rates. CostMasters tracks more than 200 commodities with few clicks. Not only real-time price tracking but CostMasters offers you the forecasting reports as well.

Check the samples below to track natural rubber price today ;

Now you can track the natural rubber prices with few clicks. Visit the official website of CostMasters to track natural rubber price today.

CostMasters also offers the natural rubber RSS4 price forecasting reports. The sample is given below;

Why Rubber Prices are Increasing?

Adverse Climate Condition

Excessive rainfall in major rubber-producing nations such as Thailand and Vietnam is disrupting production and causing global supply shortages, which are driving up natural rubber prices. Similarly, heavy rainfall in Kerala is expected to impact domestic rubber production.

Delays in Imports

A surge in Chinese exports has strained global rubber supply chains, causing transportation delays due to the high demand for shipping containers. This has affected India’s domestic rubber market, leading companies to seek local suppliers, which in turn is driving up prices.

Increased Consumption of Natural Rubber

Despite slight YoY increase in Natural Rubber production by 2.1%, from 8.39 lakh tonnes to 8.57 lakh tonnes, consumption has surged by 4.9%, rising from 13.5 lakh tonnes to 14.16 lakh tonnes, widening the deficit.

Recent Rubber Price Related News

India Grapples with Severe Natural Rubber Shortage, Prices Skyrocket

- India faces a significant natural rubber (NR) shortage, with domestic production falling short by 5.5 lakh tonnes despite a slight increase in production from 8.39 lakh tonnes in 2022-23 to 8.57 lakh tonnes in 2023-24.

- NR consumption has surged to 14.16 lakh tonnes, maintaining the production deficit, while high customs duties and availability issues have complicated imports, causing prices to soar.

- Global factors, including China’s stockpiling and turmoil in Bangladesh, are adding to the scarcity of NR, pushing prices to a 15-year high of Rs 247 per kg, nearly double the Rs 182 per kg price in April 2024.

Natural rubber price hit an all-time high of Rs. 244 in domestic market

- The price of natural rubber in the domestic market hit an all-time high of Rs. 244 per kg for RSS-4 grade sheet rubber, surpassing the previous record of Rs. 243 per kg set in 2011.

- International rubber prices are also rising, with predictions that domestic prices will exceed Rs. 250 per kg as tyre companies begin purchasing rubber at Rs. 250 to Rs. 255 per kg.

- The price surge is driven by reduced production in other rubber-producing countries, adverse weather conditions, and stock shortages among tyre companies, leading to continued market growth.

Adverse weather hits natural rubber production leading to shortage, says board bl-premium-article-image

- Adverse weather conditions, especially heavy rains, have reduced natural rubber production by limiting tapping days, with 857,000 tonnes produced in 2023-24 against a demand of 14,16,000 tonnes, according to the Rubber Board.

- The automobile industry’s growth has increased demand for natural rubber in tyre manufacturing, but international trade struggles due to container shortages have impacted rubber imports.

- Rubber Board Executive Director M Vasanthagesan urged farmers to tap trees consistently and collaborate with Rubber Producers’ Societies to ensure maximum production and take advantage of higher prices.

Natural rubber consumers seek duty-free imports amid raw material shortage

- Natural rubber (NR) consumers are urging for duty-free imports, citing an actual availability of only 30,000 tonnes in June, compared to the projected 60,000 tonnes, and almost no sales in July, which has severely impacted industries from small rubber units to large tyre companies.

- Tyre companies, experiencing a 10% drop in production due to the NR shortage, are struggling as domestic supply fails to meet expectations.

- MSME rubber industries are facing severe challenges due to limited NR stock, high domestic prices, and import duties, leading to calls for an independent study to reassess NR stock levels and urging the government for immediate intervention to stabilize raw material availability.