Introduction

Keep up with India’s most recent zinc price per kg. Make educated business judgements by keeping track of past data and examining market trends. To assist you with navigating the zinc market, CostMasters offers precise and trustworthy insights.

Track Zinc Price Per KG Today in India with CostMasters

When CostMasters was first established in 2013, its main goal was to offer accurate tracking of zinc prices per kg along with a number of other important commodities. Our capabilities have grown throughout time, and by 2024, we are monitoring and updating prices for more than 200 commodities in a variety of businesses.

Because of our platform’s intuitive dashboard, users can easily browse through our wide range of price tracking choices and swiftly get crucial data. You may get the most recent zinc prices per kg with a few clicks, along with other useful market information to help you make well-informed buying and selling decisions.

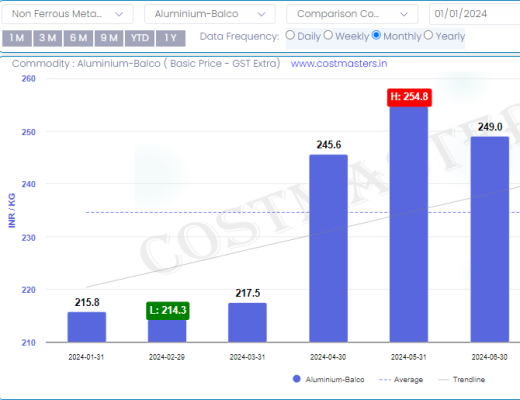

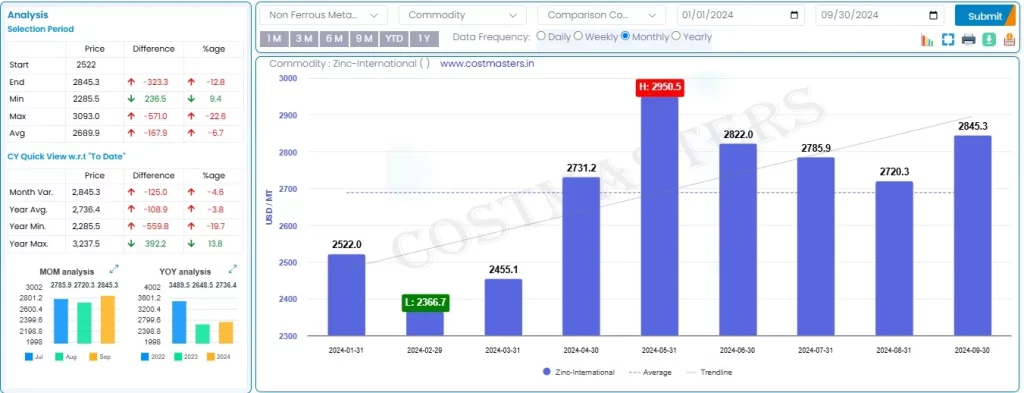

CostMasters makes sure that tracking commodity prices is easy and effective for everyone, whether you are an individual buyer, industry analyst, or business owner. Check the sample below;

Why Zinc Price are Increasing?

- Drop in Production

China is Largest producer of zinc. China’s zinc production has decreased, with July’s output dropping to a one-year low of 536,000 tons . It was at record high in December’23.

- Lower Inventories

Zinc inventories in Shanghai warehouses dropped by 9.3% signaling tighter supply. Cause prices to drive up.

- Higher Production Cost

Higher energy costs which contributes around 50% of zinc production expenses, cause higher production cost and thus effecting prices

- Positive Outlook from Major Economies

Increased manufacturing in the USA and China is driving demand for industrial metals, while China’s shift from deflation has improved market confidence.

Future Zinc Price trends

- Zinc market has strong potential, with opportunities across various sectors and is expected to reach $74.4 billion by 2027.

- BMI predicts zinc prices will drop to $2,500 in 2024, down from an average of $2,651 per ton in 2023.

Zinc Price Chart in India

CostMasters is a company that provides the tracking of zinc prices in India with just some clicks. CostMasters was established in 2013 and served more than 1000 clients and now tracking the prices of more than 200 commodities. Check the Zinc rate today with CostMasters. Just get the subscription and you can easily get the access to our simple dashboard that provides you zinc rate today,

Zinc prices vary at a very fast rate. So, it becomes very important to track the zinc price in India daily and you can make best purchasing decisions that will eventually help you to get the maximum profits.

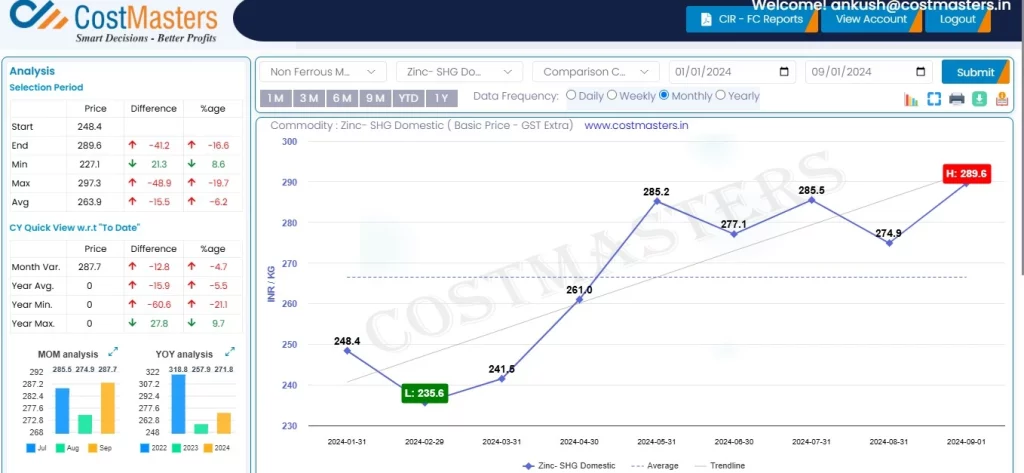

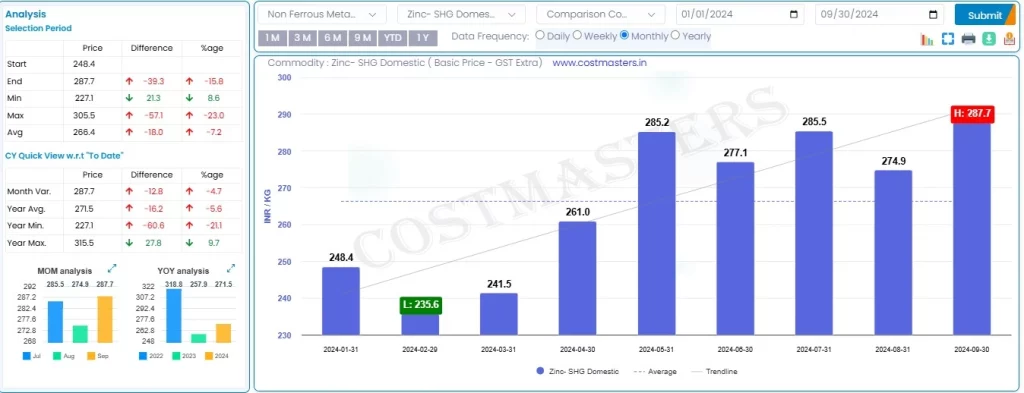

In the above screenshot, you can see that the zinc price chart is very simple and very visible to users. One can easily validate the data and easily navigate through the dashboard. The prices shown above are domestic zinc rates. CostMasters also provides you the international price where you can track the zinc price in dollars.

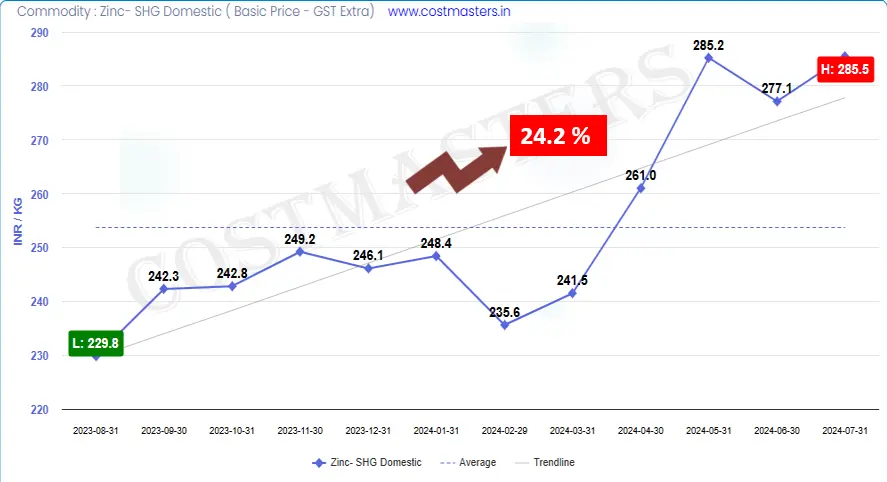

See the zinc price chart to track the zinc prices internationally in dollars,

If you want to track domestic zinc cost and international zinc cost, then CostMasters is a great option you can choose.

CostMasters provides the Zinc price forecast as well not only the current zinc cost nationally and internationally. If we talk about the accuracy then CostMasters is more than 90% accurate.

If you are going to track the domestic zinc price in India then you will get the zinc price in rs/kg. But if you are tracking the zinc price internationally , then you can track in USD/Tonne. Subscribe CostMasters today to unlock the zinc market price trends. Book free demo today and see how CostMasters solves your queries.

Recent Zinc Related News

- Zinc demand in India expected to double in the next 5-10 years due to infrastructure investments.

- Zinc is mainly used to galvanize steel to prevent corrosion.

- Current zinc demand in India: 800-1,000 tonnes per annum.

- Per capita zinc consumption in India: 0.5 kg (global average: 4 kg; developed countries: 6-7 kg).

Source: Economic Times

Zinc: Short-term outlook turns bullish

- The short-term outlook for zinc is positive based on recent technical analysis.

- Improved demand factors are contributing to the optimistic view on zinc prices.

- Analysis of market trends and technical signals suggest potential price increases for zinc. Recent market activity supports the expectation of a rising zinc market in the near term.

Source: Economic Times

Zinc defies forecasts, prices surge as supply tightens and demand rebounds

- Zinc prices have surged, defying earlier forecasts of decline.

- The price increase is driven by global supply disruptions and a rebound in manufacturing demand, particularly in the USA and China.

- Zinc’s importance in achieving net-zero carbon goals and its role in various critical sectors are boosting demand, expected to triple by 2030.

Source: smallcaps.com.au

Zinc Rises on Stronger Demand in China and Weaker Dollar

- Zinc prices have risen due to increased demand in China and a weaker U.S. dollar.

- China’s economic stimulus measures are driving stronger demand for industrial metals, including zinc.

- The weaker dollar has made zinc cheaper for buyers using other currencies, further driving up global demand. The combination of these factors has led to higher zinc prices in the market.

Source: in.investing.com