The humble roots of steel and its applications can be traced back centuries ago. But the concept of steel’s cheap mass production became popular with the inception of the Bessemer process in the mid-19th century. Today, steel is one of the most valuable and significant raw materials used in prominent industries like construction, automotive, and manufacturing.

So, it is imperative to keep pace with the daily steel price updates for businesses operating in these industries. After all, steel prices have steadily increased since the pandemic year, i.e., 2020. With skyrocketing prices, understanding the current price trend or tracking the scrap price becomes difficult. So, what might be the cause behind the rising price of steel?

Global Events and Their Impacts on Steel Prices

Steel has witnessed a dramatic increase over the past few years. Going by surveys, steel price is expected to grow in the forthcoming years. Considering the Q2 2021 update, the structural steel’s price has elevated to 91% since 2020’s fourth quarter. Surprisingly, it was 45% in the previous quarter. Here are the global impacts that might be affecting the prices of steel.

- The Russia-Ukraine War

Wars can worsen economic scenarios worldwide. The most notable example is the Russia-Ukraine War which contributed to a massive steel price hike. Steel, iron ore, and coking coal prices have risen exponentially amidst the war. Domestic price hikes are not sufficient as they cannot cover cost inflation.

The war’s first wave includes the initial disruption in the supply chains. The steel plants in Ukraine stopped production, and as a result, the USA and EU faced shortages. The supply of pig iron to the USA stopped for three months. Supplies to the EU continued by rail, but there was a decrease in the volume.

Ukrainian pig iron’s average monthly supply decreased by 87%. It was shocking for the American and European steel plants as they were the traditional importers of pig iron in Ukraine. So, the Russian and Ukraine war led to an increase in gas and steel prices. The sanctions, however, imposed against Russia decreased the total amount of capital on the steel projects.

- Pandemic

Metals get their shine back with the world being upended by the pandemic. That means there has been a rise in the prices of metals amidst the COVID-19 pandemic. The rise in raw material prices and an upsurge in engineering and infrastructural projects have impacted the daily price of steel.

In short, the 2020 pandemic triggered acute declines in prices of metals, especially steel, due to the fall in demand. There was a disrupted long-term and short-term supply, and the mining domain also witnessed a wave of capital spending cuts. After one year, the prices of industrial metals, including iron ore, reached the summit.

- China’s Massive Decisions

Certain decisions made by China have increased the steel price in India. The country eliminated the rebate relaxation on VAT, which led to an increase in the price figure.

Besides, China decreased the production of steel in order to meet domestic requirements. It reduced exporting steel to other countries, which caused a price hike. The country also suspended rebate reductions on taxes, which increased steel prices.

With an objective to eliminate or reduce pollution, China limited steel production, which reduced carbon emissions in major cities. But alongside, it also increased the price of steel.

Did You Know?

China’s struggling real estate market leads to a lack of demand for new buildings and houses. As a result, the production of steel decreases with a rise in its average price.

Other External Factors Affecting the Price: What to Know?

Note down the two external factors that affect global steel prices:

- The energy crisis and rise in the input expenses in Europe raised the prices for manufacturers who purchase or operate in European countries

- Brazil’s weather conditions also have a huge impact on the prices where amounts of aluminium and iron ore are mined (it has a drastic impact on the prices globally)

Influence of Global Steel Prices and Supply on Different Countries: India, China, Japan, and the US

Prominent countries around the world have contributed to the global steel supply chain. So, they have an immense influence on the world’s steel use. Here, the biggest players are India, China, Japan, and the US:

- India

It took less than a decade for India to outshine Japan and US steel production and become the second largest steel producer. Although steel is the cheapest metal in India, the country is still left behind on the list of exporters. So, it means the majority of steel production remains within the nation for domestic usage.

- China

China produces steel primarily for domestic purposes. But the nation has started exporting steel to other markets. The price of steel decreases due to the low labour expenses.

- Japan

The automotive manufacturing industry is huge in Japan, with the biggest players ruling the world. So, it is an open secret to believe that the nation also focuses on steel manufacturing. Compared to Indian steel manufacturing, Japan has earlier exported around a quarter of the produced steel.

- The US

The US is the 4th largest producer of steel globally. American steel manufacturers had to reduce their production amidst the pandemic, unlike other nations. In the current times, there has been an anticipated recession looming over its economy. This makes some mills hesitant to bring back the furnaces because the demand can crumble anytime shortly.

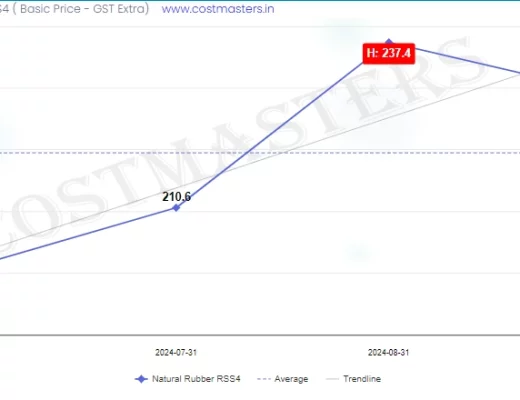

You might consider raw material price tracking services if you are into the construction, automotive, or manufacturing industry. With raw material price monitoring solutions, you can learn about fluctuating material prices.

On that note, you can consult CostMasters. We are dedicated to offering monthly CIR reports in PDF. You can also get digital RM price data from us. Clients call us the best raw material monitoring service provider. Get a safe database from us. Contact us at the soonest.